Introduction: Boeing India Aerospace Collaboration

Boeing’s reluctance to embrace India’s aerospace partnerships is becoming a costly gamble. While Airbus, Safran, Dassault, and Embraer deepen their ties with India, Boeing risks being sidelined in a global aviation market that rewards collaboration over isolation.

Aviation Industry Crisis: Boeing’s Declining Market Cap

The aviation industry crisis has exposed Boeing’s vulnerabilities. Once a symbol of American aerospace dominance, Boeing now faces financial decline and reputational damage. Its market cap lags behind Airbus, which has diversified into India’s booming aircraft manufacturing ecosystem.

Airbus vs Boeing: Lessons in Diversification

Airbus vs Boeing is no longer just a rivalry — it’s a case study in strategy. Airbus has invested in India’s maintenance, repair, and overhaul (MRO) facilities, while Boeing remains hesitant. Diversification has allowed Airbus to thrive, while Boeing’s isolation threatens its relevance.

|

| India’s aviation boom highlights Boeing’s need for collaboration. |

Boeing was once a leader in aerospace innovation, with patents spanning design, propulsion, avionics, and manufacturing. Yet, despite this trove, Boeing now appears stalled—its patents feel more like relics than growth engines.

📉 Financial Decline: Market Cap and Share Price

Boeing’s market capitalisation has eroded significantly over the past five years:

- 2019 peak share price: $430.30

- 2020 crash: -35.4%

- 2024 decline: -29.7%

- 2025 recovery attempt: +4.6% YTD

- Current market cap (Nov 2025): ~$136.15 billion

While tech giants gained trillions in value, aviation leaders like Boeing stalled, raising difficult questions about their strategic direction.

Boeing’s financial decline stems from strategic stagnation, its focus on legacy IP and limited partnerships, demonstrating the risks of isolation.

Numbers reveal Boeing’s stagnation. Compare its progress with similarly valued competitors from twenty years ago. The graph contrasts Boeing and Airbus with Apple and Microsoft—once peers, now disparate.

|

| Airbus and Boeing: sitting ducks. |

“Excuses don’t fly; diversification does.”

Tech giants became trillion-dollar companies, while aviation stalled. Boeing’s lack of diversification into IT or real estate prompts hard questions and lessons, detailed below.

📊 Key Takeaways from the Graph

Boeing and Airbus now trail far behind Apple and Microsoft, highlighting aviation’s stalled growth.

Aviation is capital-intensive. Boeing manufactures planes, but buyers and operators often come from more prosperous industries.

The question that should haunt Boeing, its promoters, and its shareholders is: Why did this happen? With similar starting points and comparable capital, why did Boeing not follow the same — or at least a similar — trajectory as Apple or Microsoft?

Excuses can’t rescue Boeing. The pressing issue is strategic blindness. Aviation failed to hedge by investing in IT or real estate. Airbus expanded into services; Boeing missed its moment. Now, survival is at stake—data shows this.

This graph is a warning. It shows Boeing what is possible — and what can still happen — if Boeing diversifies, collaborates, and uses India’s strengths.

Boeing’s finances are declining. Its market cap dropped from nearly $200B in 2019 to about $136B in 2025. The share price, once at $430, keeps falling. Strikes, safety issues, and delays hurt investor trust.

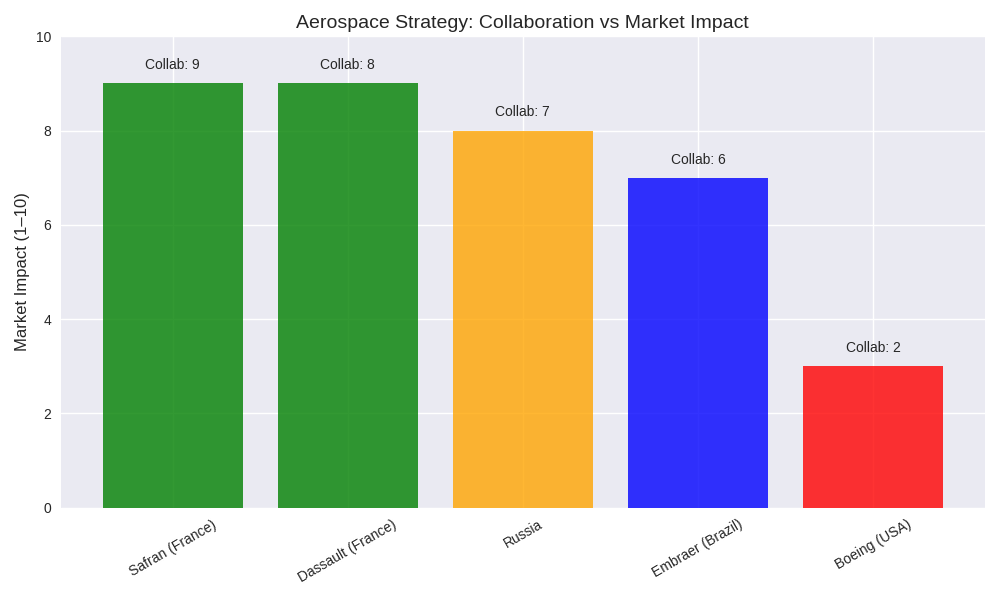

India Aerospace Partnerships: Safran, Dassault, Russia, Embraer

India’s aerospace partnerships are expanding rapidly. Safran has established an MRO hub in Hyderabad, Dassault continues to strengthen its defence ties, Russia collaborates on fighter jet programs, and Embraer explores opportunities in regional aircraft. Each partnership underscores India’s role as a co‑creator in the global aviation market.

BRICS Aerospace Alliance: A New Global Aviation Market

The BRICS aerospace alliance is reshaping the global aviation market. India, Brazil, Russia, and China are pooling resources to challenge Western dominance. Boeing’s absence from these collaborations highlights its isolation at a time when alliances drive innovation and growth.

🛩 Boeing at the Crossroads: India, Embraer, and the Future of Aerospace

Boeing faces a stark choice: embrace India or be eclipsed by India’s alliances with France, Russia, and Brazil.

Boeing’s survival increasingly hinges on U.S. government bailout packages. Washington has stepped in before, citing Boeing’s strategic importance for defence and exports. But bailouts only buy time — they do not restore competitiveness.

- Government support: Keeps Boeing afloat but does not solve structural inefficiencies.

- Market reality: Airlines want affordable, reliable aircraft. Airbus and potential India‑Embraer ventures can deliver; Boeing cannot without reform.

🚀 Safran’s Strategic Agility, Safran + BEL

Safran chose a different path: complete technology transfer to India for jet engines, including the critical “hot section.”

- Unprecedented move: India becomes the only country where Safran shares complete engine know‑how.

- Collaborations: DRDO, Tata, L&T, Adani — all engaged in co‑development.

- Outcome: Safran secures long‑term market access, revenue, and innovation.

Safran’s philosophy is straightforward: sharing is scaling. Collaboration ensures India becomes a co‑developer, not just a buyer.

🛠 Safran’s MRO Facility: India as a Global Aviation Hub

In a significant boost to India’s aviation ambitions, Safran has inaugurated its most extensive aircraft engine MRO facility in Hyderabad. This cutting-edge centre marks a strategic shift: India is no longer just assembling aircraft — it is now maintaining and sustaining them.

This facility will position India as a global MRO hub, reducing dependence on foreign service centres. India’s goal is to become the world’s aviation centre, not just a regional player. Safran is reinforcing France’s long-term commitment to India’s aerospace ecosystem.

|

| India emerges as a global aviation hub through strategic partnerships |

“Others soar, Boeing, trapped in its shell. All is not lost; Boeing can explore other opportunities in India, following Safran’s example.”

This development is more than infrastructure — it’s a signal. While Safran expands, Boeing remains confined in its shell, hesitant to localise, share, or scale.

Yet all is not lost. Boeing can still pivot. By following Safran’s example — investing in Indian MRO, training, and co-development — Boeing could reclaim relevance and credibility. India is offering the runway. Boeing must choose to land.

If Safran’s full technology transfer shows India as a trusted co‑developer, Dassault’s Rafale surge proves India is also a production hub. One partnership flows seamlessly into the next, each deepening India’s aerospace footprint.

✈️ Dassault’s Rafale Surge

India is now a Rafale production hub. Dassault Aviation has leveraged India to expand globally:

- India’s Rafale deal: 114 additional jets, worth over $22 billion — the largest defence deal in India’s history.

- Global orders: 533 firm Rafale orders by late 2025, spanning Egypt, Qatar, Greece, Croatia, UAE, Serbia, and Indonesia.

- Manufacturing shift: Rafale fuselages to be built in India, making India the first global production hub.

Dassault’s surge shows the power of visionary collaboration.

Here’s the new section you can seamlessly integrate into your longform article — positioned after the Safran section and before Dassault — to highlight recent developments and contrast Boeing’s inertia with Safran’s momentum.

From French finesse to Russian firepower, the story continues. Dassault embedded India into global supply chains, while Russia elevated India into strategic defence alignment — MiGs, Sukhois, and the S‑400 during Operation Sindoor.

🇷🇺 Russia’s Offer: Fifth‑Gen Co‑Production

Russia has long been India’s defence partner — supplying MiG‑21s, MiG‑29s, and Sukhoi Su‑30MKIs, which remain the backbone of the Indian Air Force. Building on this legacy, Russia has now signalled its willingness to share and co‑produce fifth‑generation fighter aircraft in India, including derivatives of the Su‑57 program.

- Technology Transfer: Joint development of stealth platforms with HAL and private sector partners.

- Industrial Collaboration: Local assembly and supply chain integration, ensuring Indian industry participation.

- Strategic Leverage: Diversifies India’s partnerships beyond France and the U.S., embedding Russia deeper into its aerospace ecosystem.

- Geopolitical Weight: Aligns with BRICS ambitions, showing advanced aerospace technology is no longer monopolised by the West.

For Boeing, this is another warning sign. Suppose India secures fifth‑gen aircraft technology from Russia while co‑creating civil aviation with Embraer. In that case, Boeing risks being boxed out of both defence and civil markets in one of the world’s fastest‑growing aviation hubs.

Russia’s military embrace highlights India’s defence clout, but its civil aviation sector tells a different story. Enter Brazil’s Embraer, where regional jets and South‑South collaboration show India’s role beyond fighter aircraft.

Operation Sindoor highlighted India’s aerospace geopolitics, showing how co‑creation can eclipse Boeing’s isolation.

📉 Where Would Boeing Stand?

And then comes Boeing. While others embed, transfer, and co‑create, Boeing hesitates — clinging to patents and inflated contracts. The contrast is stark.

- Patents: Stranded assets without execution.

- Market share: Further erosion as Airbus consolidates its dominance and the BRICS expand.

- Financials: Continued reliance on U.S. government bailout packages.

- Reputation: Seen as conservative, risk‑averse, and slow to adapt.

Boeing would be left gasping, unable to match the agility of Safran, Dassault, Russia, or Embraer.

📊 Concluding Comparative Chart

Here’s the concluding comparative chart that visually reinforces the “collaboration vs isolation” storyline. It pits Safran, Dassault, Russia, and Brazil–Embraer against Boeing, showing how collaboration yields a greater market impact, while isolation leaves Boeing struggling.

“India is not a buyer — it is a builder of futures.”

|

| BRICS aerospace alliance thrives while Boeing risks irrelevance |

Aircraft Manufacturing in India: Boeing’s Missed Opportunity

Aircraft manufacturing in India is no longer a distant dream — it’s a reality. With government support and international partnerships, India is positioning itself as a hub for aerospace production. Boeing’s hesitation to invest here is a missed opportunity that could cost it long‑term competitiveness.

Conclusion: Collaboration as Boeing’s Survival Strategy

Boeing must pivot from isolation to collaboration. India’s aerospace partnerships, Airbus’s diversification, and the BRICS alliance all point to a future where cooperation defines success. Without embracing Boeing's aerospace collaboration in India, the company risks irrelevance in the global aviation market.

📣 "India is no longer just a buyer — it is a co‑creator of aerospace futures. Boeing must embrace collaboration or risk being sidelined in the global aviation market. Share your thoughts: should Boeing

🔗 Suggested Readings

#Boeing #Aerospace #Innovation #Collaboration #India #Safran #Dassault #AviationIndustry #FinancialDecline #TechVsAviation